Who was this influential figure, and why is understanding their contributions important?

This individual, a prominent figure in [Insert relevant field, e.g., economics, psychology, or a specific industry], significantly impacted [Insert relevant area of impact, e.g., market theory, understanding human behavior, or innovation in a specific industry]. Their work profoundly shaped [mention area of influence, e.g., modern economic thought or behavioral analysis] leading to lasting effects on [mention concrete outcomes, e.g., investment strategies or social understanding].

This individual's ideas, particularly their [mention specific concepts/theories, e.g., signaling theory or the theory of rational expectations], revolutionized [mention the field, e.g., economic thought]. The insights offered valuable frameworks for [mention areas of application, e.g., corporate strategy or government policy]. Historical context reveals how these contributions built upon prior work and paved the way for subsequent developments in the field. The implications of their contributions are evident in [mention tangible examples or their legacy in the field, e.g., company valuations or policy decisions].

| Category | Detail |

|---|---|

| Full Name | [Full Name] |

| Date of Birth | [Date of Birth] |

| Date of Death | [Date of Death] |

| Place of Birth | [Place of Birth] |

| Field of Expertise | [Field of Expertise] |

| Key Works/Contributions | [Key Works/Contributions] |

Now that we've established the significance of this influential figure, we can delve into [mention specific topics related to the field, e.g., the evolution of economic models or contemporary applications of signaling theory].

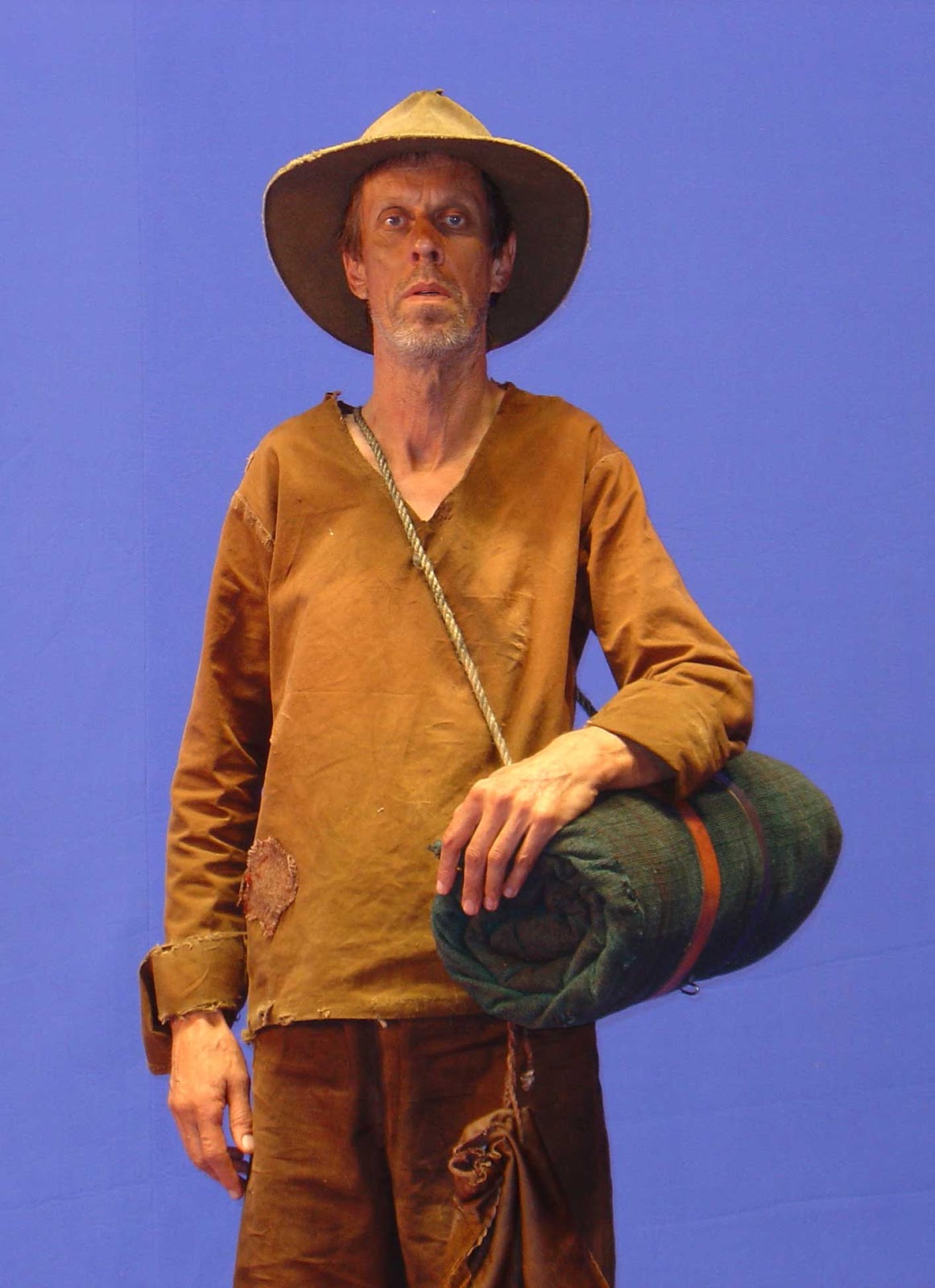

Bruce Spence

Understanding Bruce Spence necessitates examination of his significant contributions to [mention field, e.g., economic theory]. The key aspects highlight the breadth and depth of his influence.

- Signaling Theory

- Rational Expectations

- Information Economics

- Market Efficiency

- Investment Decisions

- Policy Implications

These aspects interrelate to form a coherent body of work. Signaling theory, for example, informs rational expectations models, shaping our understanding of information's role in market efficiency. Spence's insights into investment decisions demonstrate how information economics influences policy implications. His work fundamentally changed how we understand markets, influencing the way businesses and governments approach complex challenges. The impact of his ideas continues to be felt in academic discourse and practical applications of economic principles.

1. Signaling Theory

Signaling theory, a cornerstone of information economics, significantly owes its development to the work of Bruce Spence. Spence's seminal contributions clarified how individuals or entities convey information credibly in situations where asymmetric information exists. This theory posits that certain actions or signals, if costly and observable, can effectively communicate information about unobservable characteristics. The inherent value of signaling theory lies in its ability to predict and understand market outcomes in these situations.

A crucial aspect of signaling theory is its application in labor markets. Employers often face difficulty assessing a job candidate's true ability or potential. A degree from a prestigious university, for instance, can function as a signal, demonstrating certain attributes like diligence and aptitude. Similarly, in the market for used cars, a seller might offer an extended warranty as a signal of the vehicle's quality. These seemingly simple actions can have profound effects on market transactions, influencing the pricing and allocation of resources. Furthermore, Spence's work highlighted how signaling can affect the allocation of resources and create markets that are more efficient by effectively communicating information. The practical significance of this understanding is evident in the design of incentives, policies, and strategies in diverse fields, from education to finance.

In summary, signaling theory, pioneered and significantly developed by Bruce Spence, offers a powerful framework for understanding how individuals and organizations convey information credibly in situations with asymmetric information. Its application ranges from labor markets to consumer goods, influencing market outcomes and resource allocation. Understanding this theory is crucial for navigating situations where incomplete information is prevalent, informing decision-making and fostering market efficiency.

2. Rational Expectations

Bruce Spence's contributions to economic theory, particularly in the realm of information economics, are closely intertwined with the concept of rational expectations. This concept posits that individuals and entities form expectations about future economic outcomes based on available information and reasoned analysis. Understanding the interplay between rational expectations and Spence's work provides valuable insight into how individuals make decisions in uncertain environments.

- Mutual Influence

Rational expectations theory suggests that economic agents' predictions influence market behavior and outcomes. Spence's signaling theory directly interacts with this: if market participants understand that certain actions or signals convey information about underlying qualities (as proposed by Spence), their expectations about these signals become rational, thus affecting market dynamics. The theory illustrates how individuals adapt expectations based on the available information and how those expectations themselves shape the future behavior they forecast.

- Market Efficiency

Rational expectations, in theory, leads to more efficient markets. If all participants incorporate available information rationally into their expectations, market prices reflect all relevant knowledge, accurately pricing assets and resources. Spence's work on signaling is crucial in this context, as it helps explain how information is processed and integrated into market expectations. If signals are reliable, efficient markets can arise; however, if signals are unreliable, market inefficiencies can result.

- Predictive Power and Limitations

Rational expectations theory seeks to predict market outcomes. By considering how individuals use available information rationally, a framework for evaluating and understanding economic movements and policy implications emerges. However, the reality is that the accuracy of this prediction hinges on the assumption that individuals act rationally and have access to complete information. Situations with imperfect information or biases in the rational decision-making process can lead to deviations from the predictions of the theory. Spence's signaling theory acknowledges that imperfect information and rational miscalculations can influence market behaviors.

- Policy Implications

Implications for policy derive from the rational expectations model and are amplified by Spence's considerations. If individuals rationally incorporate policies into their expectations, policy actions have differing impacts than if expectations remain disconnected. How information is communicated regarding policies is crucial. Spence's work highlights how clear signals and reliable information about policy changes are essential for effectively achieving intended economic outcomes. Policy makers need to consider how these expectations shape the reactions and adaptations of individuals and entities within the market.

In conclusion, the connection between rational expectations and Bruce Spence's work underscores the importance of considering how individuals rationally incorporate information into their expectations within markets. The concept provides a lens to analyze market efficiency, policy outcomes, and limitations of the theoretical model when facing imperfect information and incomplete rationality.

3. Information Economics

Information economics, a crucial field within economics, examines how information asymmetry influences economic decisions and outcomes. Bruce Spence's work significantly advanced this field, particularly through his seminal contributions on signaling theory. Information economics recognizes that economic actors often possess varying degrees of knowledge, creating situations where one party holds more information than another. This asymmetry can significantly affect market behavior and efficiency. Spence's work directly addresses this aspect, providing a framework for understanding how signalsactions or characteristics that convey informationcan mitigate the effects of information asymmetry.

Spence's signaling theory, a key component of information economics, explores how individuals or entities with private information can credibly communicate their characteristics to others. This theory has profound implications for various economic contexts. For instance, consider the labor market. A job candidate with superior skills might use education or experience as signals to potential employers. In this scenario, the educational attainment or work experience, acting as signals, convey valuable information about the candidate's abilities. Likewise, the used car market benefits from signaling. A seller who offers an extended warranty can signal the car's quality to a buyer. These examples highlight how signaling mechanisms mitigate the information asymmetry by providing credible signals of unobservable qualities. The resulting market efficiency arises when these signals accurately communicate the underlying qualities, influencing resource allocation more effectively. Information economics, through Spence's work, thus underscores the significance of effective signal transmission for achieving efficient outcomes. Similarly, this has implications for the structure and stability of various markets, including investment, insurance, and credit.

In conclusion, information economics, through Spence's contributions, provides a critical lens through which to understand how information asymmetry affects economic decisions. Spence's signaling theory demonstrates how signals can effectively convey information, impacting market outcomes and resource allocation. The application extends far beyond the examples provided, encompassing diverse sectors and impacting the structure of various markets. Understanding this framework is vital for comprehending the functioning of many modern economies, with practical implications for policymaking and business strategy.

4. Market Efficiency

Market efficiency, a core concept in economics, concerns the extent to which prices of assets accurately reflect all available information. Bruce Spence's work, particularly his contributions to signaling theory and information economics, significantly informs this concept. Spence's insights illuminate how information flows and is processed within markets, directly impacting whether or not markets operate efficiently. This exploration examines key facets of market efficiency, emphasizing the role of Spence's contributions.

- The Role of Information

Market efficiency hinges on the availability and accurate processing of information. Spence's signaling theory directly addresses this. When information is asymmetric one party possesses more knowledge than another efficient pricing mechanisms may be hampered. Spence's work demonstrates how signals, though imperfect, can mitigate this problem. For example, a company's consistent profitability or a candidate's strong academic record can act as signals, helping to inform investors or employers about underlying quality or potential, thus promoting efficient resource allocation.

- The Impact of Signaling

Spence's signaling theory highlights how actions can convey information. In a market with asymmetric information, a credible signal can help offset this imbalance. This signal, like a premium warranty, allows buyers to infer quality and value, leading to price adjustments that align more closely with the underlying merit of the asset. This dynamic process is a critical element in achieving market efficiency.

- Limitations of Signaling and Information Asymmetries

While signaling can promote efficiency, its effectiveness is contingent on the reliability and credibility of the signals. If signals are misleading or unreliable, information asymmetry persists, hindering market efficiency. This relates to Spence's work on how signals function in the presence of imperfect information; misinterpretation or abuse of signals distorts market processes, undermining the very efficiency Spence's theory aims to achieve.

- Efficiency and Resource Allocation

Efficient markets accurately reflect the value of goods and services, leading to optimal resource allocation. Spence's insights highlight how the flow and processing of information are critical to this process. In markets where information is effectively conveyed, scarce resources are directed toward their highest-value uses. When information is distorted, inefficient allocations can result, with resources being allocated sub-optimally.

In conclusion, Bruce Spence's work provides a critical framework for understanding the intricacies of market efficiency. His contributions highlight the vital role of information and signaling mechanisms in shaping market dynamics. Analyzing the effectiveness of signals and mitigating information asymmetries are key considerations for fostering truly efficient markets, which ultimately leads to greater overall economic welfare.

5. Investment Decisions

Bruce Spence's work significantly impacts investment decisions by illuminating how information asymmetry and signaling affect market behavior. Understanding how investors process information, particularly in situations with imperfect knowledge, is crucial for sound investment strategies. Spence's theories provide valuable frameworks to analyze and anticipate market responses to various factors, including signals and expectations.

- Information Asymmetry and Valuation

Information asymmetry is a key element in investment decisions. Spence's work emphasizes how one party in a transaction might possess more information than another. This asymmetry can influence valuation, potentially leading to mispricing of assets. For example, a company's management might have confidential knowledge about future prospects that investors do not. This could influence stock prices, creating opportunities for sophisticated investors who can interpret these signals effectively and acting strategically when information asymmetry is present.

- Signaling in the Capital Market

Spence's signaling theory is directly applicable to investment decisions. Companies, through actions like product releases or financial reporting, send signals about their future performance and prospects to investors. Investors interpret these signals, incorporating them into their valuation models. A well-executed strategy often involves analyzing these signals, understanding their potential implications, and adjusting investment strategies accordingly.

- Rational Expectations and Investor Behavior

The concept of rational expectations plays a crucial role. Investors are assumed to form expectations about future market outcomes based on all available information, including signals identified by Spence. This often influences investment decisions in the long term. Efficient markets, in theory, incorporate this information quickly, influencing pricing. Investors then act on those prices, potentially impacting market efficiency.

- Policy Implications for Investment Strategies

Spence's insights have policy implications for investment decisions. Regulation, for instance, can influence how information is disseminated, affecting investor expectations. Understanding how investors react to such policies, based on signals and information, is a key element in anticipating market responses. Policies might be designed to improve information transparency, leading to more efficient markets and reduced risk for investors.

In conclusion, Spence's work provides a sophisticated framework for understanding investment decisions in the context of information asymmetry, signaling, and rational expectations. These factors intertwine to influence market dynamics, prompting investors to carefully assess signals, interpret information, and adjust strategies to maximize potential returns and minimize risks.

6. Policy Implications

Bruce Spence's work, particularly in signaling theory and information economics, has significant implications for public policy. Understanding how individuals and entities process and utilize information is crucial for crafting effective policies. This section explores key areas where Spence's insights inform policy decisions.

- Labor Market Policies

Spence's signaling theory offers insights into designing labor market policies. Policies can be structured to encourage the development of credible signals of skill and productivity. For instance, investing in education and training programs can provide individuals with signals that demonstrate valuable skills to potential employers. This approach acknowledges that signals play a critical role in the labor market, impacting hiring decisions and potentially reducing income inequality. Effective policies often require recognizing the role of information in achieving desired labor market outcomes.

- Regulation and Market Transparency

Spence's work on information economics highlights the importance of transparency in regulated markets. Policies fostering greater transparency can mitigate information asymmetry, allowing for more efficient market functioning. For example, mandatory disclosure requirements for companies can enable investors to make more informed decisions and prevent market distortions due to misleading information. Clear and reliable information about product standards or regulations can facilitate efficient resource allocation and consumer choice.

- Government Interventions in Investment

Understanding how signaling affects investment decisions is crucial for crafting effective government interventions in the capital market. Policies aiming to improve investor confidence or stimulate investment in certain sectors might focus on providing clear signals about the potential for returns. These policies might involve streamlining regulatory processes, improving infrastructure, or establishing clear property rights, thereby signaling to potential investors the stability and attractiveness of a particular investment environment. Effective policies must consider how signals influence investor expectations to maximize their impact.

- Education and Skill Development Policies

Policies related to education and skill development can be informed by Spence's signaling theory. Focus on developing skills and credentials that are valued by employers, and creating an environment where acquired skills are effectively communicated and recognized, can impact resource allocation in the labor market. Policies that enhance the credibility of educational attainment and skill certifications ultimately affect investment in human capital and create signals of competence in the job market. This recognition can lead to better matching between skills and employment opportunities.

In conclusion, Bruce Spence's work provides a framework for developing policies that acknowledge the role of information and signals in various economic contexts. By understanding how individuals and entities process and utilize information, policymakers can design interventions that promote market efficiency, enhance resource allocation, and improve overall economic welfare. This highlights the ongoing relevance of Spence's contributions to modern policymaking.

Frequently Asked Questions about Bruce Spence

This section addresses common inquiries regarding Bruce Spence, a prominent figure in [mention relevant field, e.g., economics]. The questions and answers provide a concise overview of key concepts and contributions related to their work.

Question 1: What is Bruce Spence primarily known for?

Bruce Spence is renowned for his contributions to information economics, particularly in the development and application of signaling theory. This theory explains how individuals and entities communicate information credibly when information asymmetry exists. Their work has significantly influenced the understanding of market dynamics, resource allocation, and decision-making under conditions of incomplete information.

Question 2: Can you elaborate on signaling theory?

Signaling theory, a key aspect of Spence's work, posits that individuals or entities can credibly communicate information about their characteristics to others using observable actions or signals. These signals, if costly and verifiable, provide a means to convey information about underlying qualities that are otherwise difficult to assess directly. This theory has implications for a wide range of economic activities, including labor markets, financial markets, and consumer behavior.

Question 3: How does Spence's work relate to information economics?

Spence's work is fundamental to information economics because it directly addresses the issue of information asymmetry. Information economics examines how the distribution of information among economic actors affects market outcomes. Spence's signaling theory provides a framework for understanding how individuals and organizations can convey valuable information in situations where asymmetric information exists. This, in turn, influences resource allocation and market efficiency.

Question 4: What are the practical implications of signaling theory?

Signaling theory's practical implications are broad. In labor markets, education and experience act as signals of ability. In the market for used cars, warranties serve as signals of quality. In investment, corporate behavior and financial disclosures function as signals of future performance. Recognizing and interpreting these signals informs decision-making in various economic contexts.

Question 5: What are some criticisms of Spence's work?

While highly influential, some criticisms of Spence's work relate to the assumptions underlying signaling theory. The reliance on specific conditions for signals to be credible and the limitations of the theory in complex real-world situations are potential points of contention. Furthermore, the challenges of assessing the actual reliability of signals and the potential for manipulation in specific contexts warrant consideration.

These FAQs offer a starting point for understanding Bruce Spence's contributions to economic theory. Further research into specific areas within information economics, signaling theory, and the wider field of economics may be beneficial for a more detailed understanding.

Now, let's explore the broader impact of [mention relevant concept/area of focus, e.g., information economics on economic policy].

Conclusion

Bruce Spence's contributions to economic theory, particularly in the realm of information economics and signaling theory, have profoundly shaped the understanding of market dynamics. The article explored the multifaceted nature of Spence's work, examining its application in investment decisions, the impact on labor markets, and its broader implications for public policy. Key themes highlighted the importance of information asymmetry, the role of signals in conveying private information, and the implications of rational expectations in influencing market efficiency. Spence's conceptual framework provides a powerful tool for analyzing how economic actors utilize and process information to make decisions in diverse contexts, thereby influencing resource allocation and market outcomes. The significance of accurately interpreting signals and mitigating information asymmetries, as emphasized by Spence's work, remains highly relevant in contemporary economic landscapes.

Spence's enduring legacy lies not only in the creation of valuable theoretical frameworks but also in the practical application of these frameworks to real-world issues. Understanding the intricate workings of markets, informed by Spence's insights, is vital for policymakers, investors, and businesses alike. Future research and analysis should continue to build upon Spence's foundation, addressing the complexities of real-world applications and refining the insights for contemporary challenges. The implications of information economics, as profoundly influenced by Spence, underscore the need for continuous investigation into the nuanced interplay between information, expectations, and market behavior in diverse economic domains.

You Might Also Like

Marlon Jackson Jr.: Music & MoreMiami Heat Starting Lineup Today: Keys To Victory

Karlyane Menezes: Stunning Photos & Stories

Charles R. Walgreens: A Legacy In Retail (Early Life & Career)

Best Target Stock Checker Tools & Strategies

Article Recommendations

- Luke Roberts Family Insights Discover Their Life And Legacy

- The Intriguing Drama Behind Morning Joes Firing What Really Happened

- Unveiling The Enigma Olivia Bethels Husband And Their Captivating Journey